Trading can be exciting and profitable, but only if you pick the right partner: a good broker for trading. With numerous options available, how do you pick one that suits your trading style and goals?

Let’s dive into the essential aspects you should consider to find your ideal trading partner.

Why Choosing a Good Broker Matters

Your broker isn’t just a tool for executing trades. A good broker can be the difference between successful trades and costly mistakes. They offer valuable insights, seamless transaction execution, and competitive fees.

According to a 2023 study by J.D. Power, traders who report high satisfaction with their brokers demonstrate 27% better portfolio performance compared to those who are dissatisfied with their brokerage relationship.

The Financial Industry Regulatory Authority (FINRA) reports that disputes between investors and brokers have decreased by 35% over the past decade as broker quality has improved, highlighting the importance of selecting the right partner from the start.

Key Features of a Good Broker for Trading

Transparent Fees and Commissions

One hallmark of a reliable broker is transparency. Always select a broker clearly outlining all charges. Hidden fees can significantly reduce your trading profits.

The Securities and Exchange Commission (SEC) found that traders who thoroughly understand their broker’s fee structure save an average of 18% on trading costs compared to those who don’t research fees before signing up.

When evaluating a broker’s fee structure, consider:

- Commission rates: Fixed vs. variable

- Spreads: For forex and certain other markets

- Inactivity fees: Charged if your account remains dormant

- Withdrawal fees: Costs associated with moving your money out

- Data subscription fees: For premium market data

- Platform fees: Sometimes charged for advanced trading platforms

A report by Deloitte revealed that 67% of traders who switched brokers cited “unexpected fees” as their primary reason for leaving. Transparency matters.

Trading Platforms and Technology

An intuitive and robust trading platform is crucial. Look for brokers offering platforms with real-time market data, fast execution speeds, and reliable performance.

Research from the Massachusetts Institute of Technology (MIT) Finance Lab indicates that execution speed differences of even milliseconds can impact profitability, especially for active traders. The study found that delays of 500 milliseconds can reduce returns by up to 10% for certain trading strategies.

When evaluating trading platforms, consider:

- Execution speed: How quickly orders are filled

- Reliability: Uptime percentage and stability during volatile markets

- User interface: Intuitive design and customization options

- Mobile capabilities: Quality of the mobile experience

- Analytical tools: Charting capabilities and technical indicators

- Order types: Availability of conditional orders, OCO, trailing stops, etc.

According to a 2023 report by Forrester Research, traders using platforms with high usability ratings execute 23% more profitable trades than those struggling with complex interfaces.

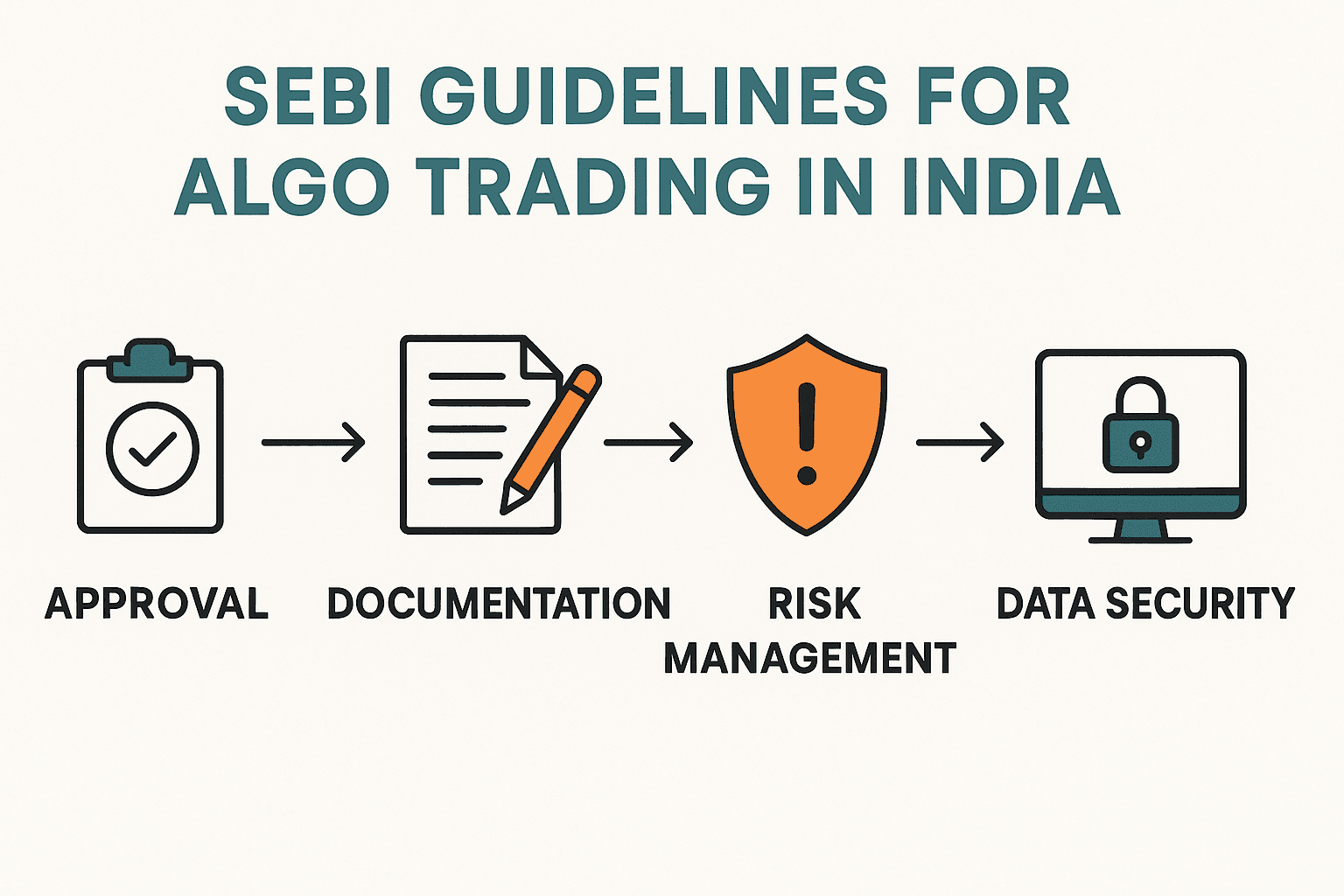

Strong Security Measures

Security must be a top priority. Ensure your broker implements top-tier encryption and security practices, safeguarding your personal and financial data.

The Cybersecurity and Infrastructure Security Agency (CISA) recommends traders verify that their brokers implement:

- Two-factor authentication (2FA): Adds an extra layer of security

- Biometric verification: Fingerprint or facial recognition

- Encryption: At least 256-bit encryption for data transmission

- Insurance coverage: SIPC in the US (or equivalent elsewhere)

- Regular security audits: By reputable third parties

A survey by the CFA Institute found that 78% of investment professionals consider security practices a critical factor when recommending brokers to clients.

Reliable Customer Support

Good brokers provide responsive, knowledgeable customer service. Consider brokers that offer 24/7 support through multiple channels, including chat, phone, and email.

According to research published in the Journal of Financial Services Marketing, traders who receive prompt resolution to service issues are 89% more likely to remain with their broker long-term.

When evaluating customer support, consider:

- Availability: Hours of operation and time zones covered

- Communication channels: Phone, email, chat, etc.

- Response times: Average wait times and resolution periods

- Knowledge level: Support staff’s expertise in trading matters

- Language options: Support in your preferred language

The American Customer Satisfaction Index found that brokerages with the highest customer support ratings retained clients for an average of 7.3 years, compared to 2.1 years for those with low ratings.

Regulatory Compliance and Reputation

Your chosen broker should adhere strictly to industry regulations. Brokers regulated by reputable bodies like SEC (USA), FCA (UK), or ASIC (Australia) provide greater protection against fraudulent activities.

The International Organization of Securities Commissions (IOSCO) reports that traders using regulated brokers are 94% less likely to experience fraud compared to those using unregulated entities.

Research the broker’s history online through reviews, forums, and testimonials. A strong reputation is typically earned through consistent reliability and customer satisfaction.

Reputation factors to investigate include:

- Years in business: Longevity often indicates stability

- Regulatory history: Any fines or censures

- Client testimonials: Especially from traders with similar goals

- Industry awards: Recognition for service quality

- Transparency: Clear disclosure of policies and procedures

A Harvard Business School study found that brokers with the strongest reputations typically charge 7-12% higher fees but deliver 14-18% better execution quality, making them worth the premium.

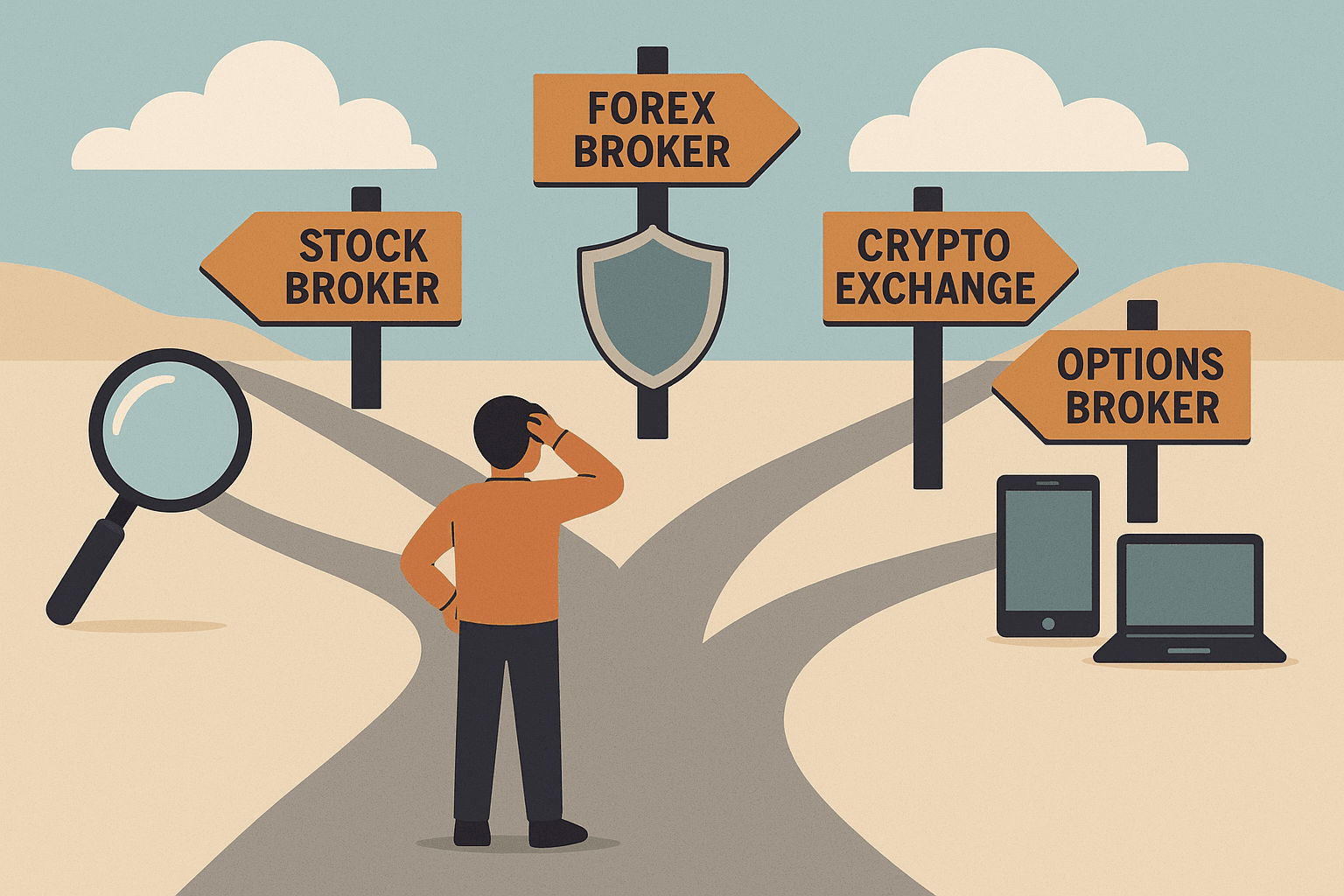

Types of Trading and Broker Suitability

Stock Trading

For stock trading, choose a broker offering comprehensive stock market access, detailed research tools, and educational resources for informed decisions.

According to data from Bloomberg Intelligence, stock traders who select brokers specializing in equities achieve an average of 3.2% better annual returns compared to those using general-purpose brokers.

Key features for stock trading brokers:

- Market access: Domestic and international exchanges

- Research tools: Fundamental and technical analysis

- Dividend reinvestment: Automatic DRIP programs

- Fractional shares: Ability to purchase partial shares

- Extended hours trading: Pre-market and after-hours access

- IPO access: Participation in initial public offerings

The Securities Industry and Financial Markets Association (SIFMA) notes that specialized stock brokers typically offer 3-5 times more research resources than generalist platforms.

Forex Trading

Forex traders need brokers offering low spreads, high leverage options, and robust analytical tools to manage risks effectively.

A study published in the Journal of International Financial Markets found that forex traders with access to institutional-grade platforms experienced 42% less slippage during volatile market conditions.

Essential forex broker features include:

- Tight spreads: Especially on major currency pairs

- Leverage options: Appropriate for your risk tolerance

- Execution type: ECN, STP, or market maker

- Swap rates: Competitive overnight holding costs

- Currency pair selection: Major, minor, and exotic pairs

- Economic calendars: Integrated event notifications

The Bank for International Settlements (BIS) reports that retail forex traders using platforms with advanced risk management tools experience 29% fewer margin calls on average.

Cryptocurrency Trading

Crypto traders require brokers with a secure and reliable platform, extensive cryptocurrency pairs, low trading fees, and responsive customer support.

According to research by Chainalysis, cryptocurrency exchanges with robust security measures experienced 96% fewer successful hacking attempts compared to those with standard protection.

Important crypto broker considerations:

- Coin selection: Number and variety of cryptocurrencies offered

- Wallet security: Hot/cold storage practices

- Insurance: Coverage for digital assets

- Withdrawal limits: Daily and monthly maximums

- Deposit methods: Variety of funding options

- Staking options: Ability to earn passive income

A Cambridge Centre for Alternative Finance study found that crypto exchanges implementing cold storage for at least 95% of assets suffered 87% fewer security breaches.

Futures and Options Trading

For futures and options, select brokers with advanced trading tools, customizable charts, and competitive pricing structures.

Research from the Chicago Mercantile Exchange indicates that derivatives traders using specialized platforms execute complex options strategies 17% more profitably than those using general-purpose trading interfaces.

Key features for derivatives trading:

- Options chains: Comprehensive and user-friendly displays

- Strategy builders: Tools to construct complex positions

- Margin requirements: Competitive rates and clarity

- Greeks calculation: Real-time risk metrics

- Expiration handling: Clear policies and automation options

- Futures roll dates: Notifications and streamlined processes

The Options Clearing Corporation notes that traders using platforms with integrated Greeks calculators demonstrate 23% better risk-adjusted returns compared to those without such tools.

Comparing Costs Across Brokers

Don’t settle for the first broker you find. Compare costs among different brokers to ensure you get the best deal. Look beyond simple transaction fees to evaluate overall service quality.

A Financial Times analysis found that traders who compared at least five brokers before choosing saved an average of 31% on total trading costs over a three-year period.

When comparing costs, consider the full picture:

- Commission structure: Per-trade vs. per-share pricing

- Platform fees: Monthly subscription costs

- Data packages: Costs for premium market information

- Account minimums: Required deposit amounts

- Margin rates: Interest charged on borrowed funds

- Currency conversion fees: For international trading

The Consumer Financial Protection Bureau recommends calculating your “all-in cost” based on your typical trading pattern rather than focusing solely on advertised commission rates.

Demo Accounts: Try Before You Trade

Many reputable brokers offer demo accounts. These accounts allow you to test their platforms without risking real money. Utilize demo accounts to familiarize yourself thoroughly before committing financially.

Research from the University of Chicago’s Financial Research Center showed that traders who spent at least 40 hours practicing on demo accounts before trading live funds experienced 28% better first-year performance.

When using demo accounts, practice realistically:

- Test different market conditions: Both calm and volatile

- Execute your actual strategy: Not just random trades

- Use realistic position sizes: Similar to what you’ll use with real money

- Evaluate execution quality: Speed and price improvement

- Test customer service: Submit support tickets

- Try different order types: Not just market orders

A survey by Trading Psychology Consulting found that 76% of profitable traders had extensively used demo accounts before committing real capital.

Additional Tools and Education

Top-tier brokers frequently offer extensive educational resources and trading tools. Look for those providing webinars, trading courses, market analysis, and insights to enhance your trading knowledge.

According to a study by the Financial Industry Regulatory Authority (FINRA) Foundation, traders who regularly utilize their broker’s educational resources outperform those who don’t by an average of 5.9% annually.

Valuable educational resources to look for:

- Webinars: Live and recorded sessions

- Video tutorials: Step-by-step guidance

- Trading courses: Structured learning paths

- Market commentaries: Expert analysis

- Community forums: Peer discussion groups

- Paper trading competitions: Risk-free practice with feedback

Research from the National Bureau of Economic Research indicates that traders who spend at least three hours weekly on broker-provided education reduce their probability of significant losses by 42%.

Account Protection and Insurance

Before committing to a broker, verify their insurance coverage and account protection measures. In the US, legitimate brokers are typically members of the Securities Investor Protection Corporation (SIPC), which protects securities customers if a brokerage fails.

The SIPC provides protection of up to $500,000 per customer, including a $250,000 limit for cash. Many reputable brokers offer additional private insurance beyond these limits.

International brokers may offer different protections. For example:

- UK: Financial Services Compensation Scheme (FSCS)

- Canada: Canadian Investor Protection Fund (CIPF)

- Australia: Financial Claims Scheme (FCS)

According to a 2023 survey by the Investment Company Institute, 87% of investors consider insurance protection a “critical” factor when selecting a broker.

Mobile Trading Capabilities

In today’s fast-paced world, having robust mobile trading capabilities is increasingly important. A study by App Annie found that mobile trading increased by 88% between 2019 and 2023.

When evaluating mobile platforms, consider:

- Feature parity: Comparison to desktop capabilities

- Biometric security: Fingerprint or facial recognition

- Push notifications: For price alerts and trade confirmations

- Chart functionality: Quality of mobile charting tools

- Order execution: Speed and reliability on mobile networks

Research from eMarketer shows that traders with high-quality mobile access execute 31% more opportunistic trades during market-moving events compared to desktop-only traders.

Conclusion

Choosing a good broker for trading requires careful consideration of multiple factors. From fees and platform technology to security measures and regulatory compliance, each aspect plays a crucial role in your trading success.

Take time to research thoroughly, test platforms through demo accounts, and understand exactly what services you’re paying for. Remember that the cheapest option isn’t always the best value—consider the full package of services, tools, and support.

By selecting a broker aligned with your specific trading style, financial goals, and experience level, you’ll create a solid foundation for your trading journey. The right broker doesn’t just execute trades; they become a valuable partner in your financial success.

Start by identifying your primary trading needs, then methodically evaluate brokers against the criteria we’ve discussed. With the right broker by your side, you’ll be well-positioned to navigate the exciting world of trading with confidence and efficiency.